Following sustained representations from SAGA, our Legal Chair’s efforts have, at last, elicited a clear directive from SARS regarding the source-code to be reflected on actors’ IRP5 certificates. This effectively puts cash back into performers’ pockets each year!

To understand the significance of this document, let’s return to first principles:

As freelancers, actors are taxed a flat-rate of 25% on everything they earn. However, some of our colleagues may be unaware that they are allowed to offset legitimate business expenses against their income when submitting their tax returns each year. In some cases this can result in a refund of up to a quarter of their annual income. Nice.

But this is not a perk; as an independent contractor, it costs money to keep your business running. In the case of actors, there are fresh headshots and an updated show-reel to consider, as well as private coaches in specialised skills and even grooming. Running a home-office costs money; one needs access to email and a mobile phone, while travelling expenses to and from castings, auditions, rehearsals and performances (not to mention parking) all add up. Fortunately, the tax-man recognises that any investment ploughed back into the running of a sustainable business is not regarded as income and should therefore not be taxed.

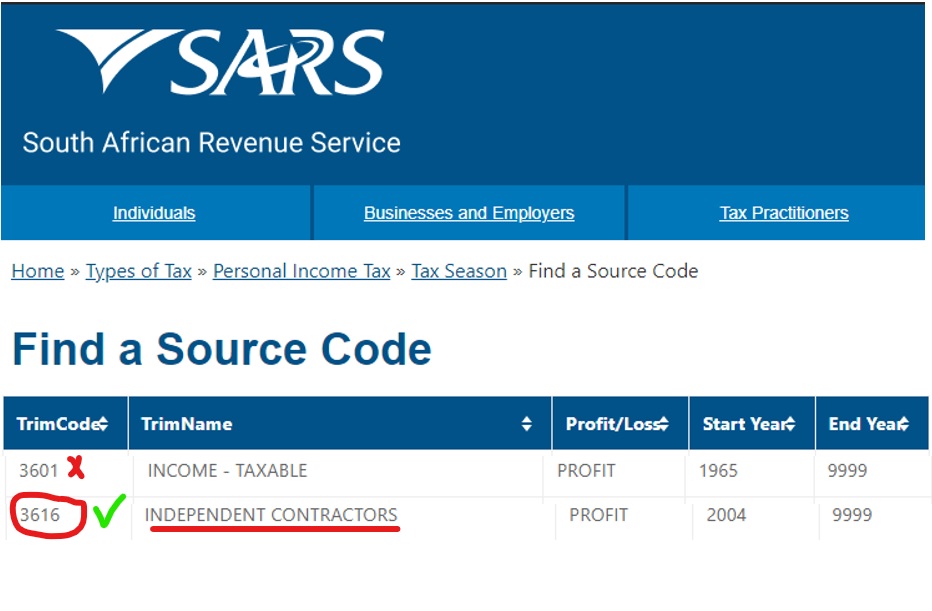

Of course, a full-time employee does not incur these expenses in generating their pay-check each month, and so they are expressly prohibited from claiming deductions. When issuing an IRP5, employers on the one hand, and those engaging actors for their services on the other, (such as producers, theatre managements and advertising agencies) are expected to specify the type of remuneration being accounted for by way of a source code: 3601 for employees and 3616 for independent contractors. (SARS has more than 80 source categories, each of which is treated in a unique way when calculating tax liabilities.)

It is worth mentioning that in some cases a business may in fact reap a tax benefit by inflating its ‘payroll’, offsetting wages and salaries against its trading income. This is not to suggest that an incorrect tax-code on an IRP5 is always the result of willful dishonesty, but the reluctance to correct the ‘mistake’ once it is brought to a producer’s attention does beg the question. A case in point: an artist recently submitted to a management numerous polite requests for an incorrect IRP5 to be amended. This was followed by a series of back-and-forth correspondence from SAGA’s Legal Desk. The management refused to budge, with a final rebuff that read: “She knew what she had to do and did not do it or alert us in time. Regretfully it is a problem of her own making and not ours.”

Fortunately SARS disagrees, pointing out that any management who refuses to correct an IRP5 once they are made aware of a problem, is committing an offence. Yes, a criminal offence! On conviction, this felony is punishable by a fine or imprisonment, together with a possible penalty of 10% of their entire payroll during that year. In the eyes of the Law there is nothing trivial about an innocuous-looking string of digits! For the full chapter and verse of the relevant legislation cited by SARS, a copy of the letter spells it out.

In an effort to keep bullies off of our playground, you can rest assured that SAGA will continue to keep its members informed of their rights.